Running a business can be a thrilling endeavor, but for some, it comes with unique challenges. In the world of commerce, certain businesses are deemed high-risk due to various factors such as industry volatility, chargeback rates, and regulatory concerns.

If you find yourself in this category, fear not – HighRiskPay.com is here to help.

A high-risk merchant account is a specialized financial service designed for businesses with increased risk, offering solutions and flexibility in processing transactions that traditional accounts do not provide.

In this article, we’ll demystify the concept, explore why businesses opt for high-risk merchant accounts, delve into key features, and provide practical insights for a seamless experience.

Understanding High-Risk Merchant Accounts – Awareness of Merchant Accounts!

1. What Makes a Business High-Risk:

Before diving into solutions, it’s crucial to understand what classifies a business as high-risk. Factors like the nature of the industry, previous chargeback history, and regulatory compliance can contribute to this classification.

2. The Importance of High-Risk Merchant Accounts:

High-risk businesses face challenges in obtaining traditional merchant accounts. A high-risk merchant account becomes a lifeline, enabling businesses to accept payments securely.

Features and Benefits – Unlock Your Success!

HighRiskPay.com stands out as a reliable provider for high-risk merchant accounts. With features like quick approvals and competitive rates, it caters to businesses that may struggle elsewhere.

Benefits:

- Increased Efficiency: Uncover how specific features translate into tangible benefits, such as increased operational efficiency.

- Cost Savings: Explore how the right features can lead to significant cost savings for businesses.

- Enhanced User Experience: Delve into the ways in which features contribute to an enhanced user experience, fostering customer satisfaction and loyalty.

Features:

- User-Friendly Interface: Explore how a user-friendly interface contributes to a positive user experience and drives adoption.

- Advanced Security Measures: In an era of cyber threats, understand the importance of advanced security features and how they safeguard users and businesses.

- Seamless Integration Capabilities: Learn how seamless integration capabilities can streamline processes and enhance overall efficiency.

How HighRiskPay.com Mitigates Risks? – Secure Your Transaction Now!

Understanding that risk is inherent, HighRiskPay.com employs robust risk management strategies to protect both businesses and consumers.

1. Eligibility Criteria:

In the vast landscape of opportunities, eligibility criteria serve as gatekeepers, determining who can access education, employment, financial resources, and government assistance.

2. Required Documentation:

The application process involves submitting specific documents, and understanding these requirements can expedite your approval.

3. Processing Time:

The concept of processing time holds significant relevance across various industries and everyday activities. From e-commerce transactions to loan approvals and immigration processes, understanding and optimizing processing time can be a game-changer.

Fees and Charges – What to Expect!

1. Transparent Pricing:

HighRiskPay.com prides itself on transparent pricing. Learn about the fees associated with their services and how it compares to industry standards.

2. Common Fee Structures:

Fee structures form the bedrock of financial transactions, dictating how professionals and businesses are compensated for their expertise and offerings. From hourly rates to subscription-based models, understanding common fee structures is essential for both service providers and clients.

Security Measures in Place – Check safety now!

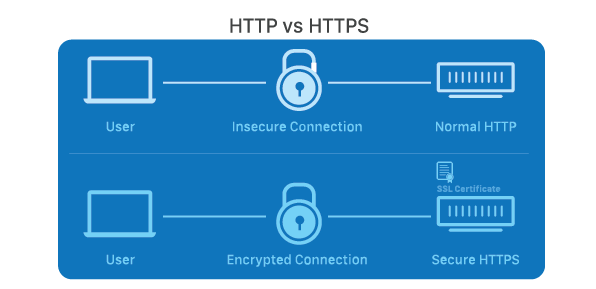

1. SSL Encryption:

Security is paramount. HighRiskPay.com uses SSL encryption to ensure that all transactions are secure and private.

2. Fraud Prevention Mechanisms:

The need for robust fraud prevention mechanisms has become paramount. As technology advances, so do the tactics of fraudsters, making it crucial for businesses and individuals alike to stay ahead in the game of prevention.

Let’s explore the intricacies of fraud prevention, its key components, and the evolving landscape of safeguarding against fraudulent activities.

Read: Inter Milan Vs Fc Porto Timeline –An Interesting Football Journey!

Customer Success Stories – Know the Power!

1. Real-world Examples:

Discover how businesses, similar to yours, have thrived with HighRiskPay.com as their trusted high-risk merchant account provider.

2. Testimonials:

Hear directly from satisfied clients about their experiences with HighRiskPay.com.

Comparing HighRiskPay.com with Competitors – Interact With Others!

1. Unique Selling Points:

Unique Selling Points (USPs) are the distinctive qualities or features that set a product or service apart from its competitors.

2. User Experiences:

User Experiences (UX) refer to the overall experience a person has when interacting with a digital product or service, encompassing aspects such as usability, accessibility, and satisfaction.

Tips for Managing a High-Risk Merchant Account – Advantages!

1. Best Practices:

A high-risk merchant account is a specialized financial account for businesses operating in industries prone to higher chargeback rates, legal uncertainties, or other risk factors.

2. Common Pitfalls to Avoid:

Learning from the mistakes of others is a valuable approach to avoid pitfalls and ensure success in managing high-risk merchant accounts.

Read: Auractive – The Amazing Technique!

Staying Compliant with Regulations – Ensure Regulatory Compliance Now!

1. Industry Standards:

Industry standards refer to a set of guidelines, criteria, or specifications established to ensure uniformity, quality, and safety across various sectors.

2. Legal Considerations:

Legal considerations refer to the crucial aspects of law and regulations that businesses must account for in their operations to ensure compliance and mitigate legal risks.

Emerging Trends in High-Risk Merchant Services – Explore Now!

1. High Transaction Fees:

Examining the conventional challenges, including higher fees associated with high-risk transactions.

2. Strict Underwriting and Approval Processes:

Detailing the stringent underwriting and approval processes that high-risk businesses typically undergo.

FAQs:

1. What Defines a High-Risk Business?

We break down the criteria that define a business as high-risk and how it impacts your merchant account.

2. Why Choose HighRiskPay.com Over Other Providers?

Uncover the unique advantages of choosing HighRiskPay.com for your high-risk merchant account needs.

3. Can I switch from another provider to HighRiskPay.com easily?

Yes, the process of switching to HighRiskPay.com is designed to be seamless for businesses.

4. How Does High-Risk Processing Impact My Business?

Understanding the impact of high-risk processing on your day-to-day operations.

5. Is HighRiskPay.com Suitable for Startups?

Startup considerations when opting for a high-risk merchant account with HighRiskPay.com.

Conclusion:

Navigating the complexities of high-risk businesses requires a reliable partner, and HighRiskPay.com emerges as a beacon in this era that helps in understanding high-risk merchant accounts.

+ There are no comments

Add yours